The end of this fiscal year is right around the corner, and being a Mac user, it’s evident that you must be looking for an ideal way to solve your tax-related problems. If you, too, are looking for an ideal method to get your taxes done, you’re in luck. I have compiled a list of the best tax software for Mac to help you file your taxes correctly.

Whether you’re a small business owner or freelancer or just need to file your personal taxes, a tax software option on this list can help.

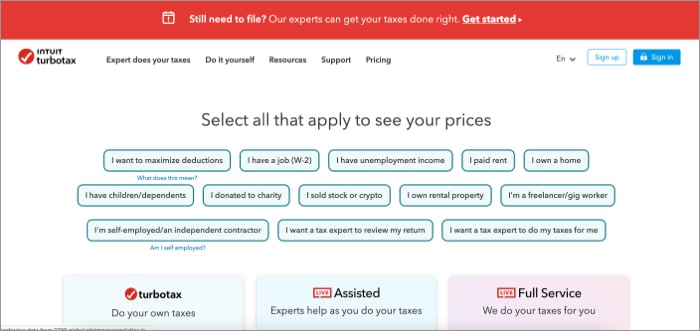

1. TurboTax – The most trusted software for filing taxes

Being one of the most popular tax software options available, this user-friendly tool is enabled to make your tax filing experience simple and straightforward. Even a novice can easily grasp the process of filing taxes with the user-friendly interface and easy-to-understand guides available with TurboTax.

Further, the software comes with support for managing multiple tax forms, tax deductions, and credits. Additionally, it is set to offer audit support and guarantees accurate calculations, giving users peace of mind when filing their taxes. The expert tax advice and tips from these plans will help you get the most from your tax return.

The TurboTax free edition allows you to follow the procedure for basic tax returns yourself for free. However, if you seek external guidance, you can choose TurboTax Live Assisted Basic or TurboTax Live Full Service Basic at the listed price. Moreover, you are sure to get the most from your tax return with expert tax advice and tips.

However, you will likely receive basic customer support if you burn through the free plan quickly. You can also opt for online versions or download the same for your Mac, which you can use at your convenience. With a comprehensive set of features and a generous free tier, it is no wonder TurboTax is one of the most popular tax software solutions available.

Pros

- IRS standard deduction

- Earned Income Tax Credit (EIC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Cons

- Windows 8.1 and macOS Catalina 10.15 software are not supported

- Only IRS Form 1040 is accepted for free tax submission

Price: Plans start at $50

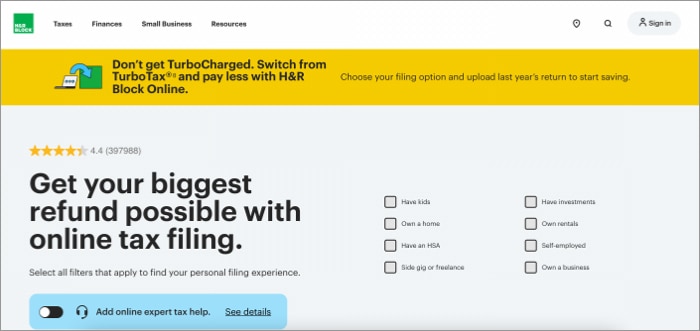

2. H&R Block – Accurate and simple

Known for its simplicity, H&R Block is another blessing in disguise, curated to help you through your tax filing process. It is ideal for someone looking for an intuitive and easy-to-use method to file taxes. Get your hands on exclusive features like tax deductions and credit optimization alongside well-organized assistance from professionals from H&R Block.

H&R Block, furthermore, offers a variety of tips, tricks, and support to help you understand the process and make it as smooth as possible. The accurate and simple interface allows you to easily navigate among different tax forms and get the best possible refund. The program can also alert you of any potential errors, ensuring you get the maximum refund possible.

The extensive database of H&R Block is set up to provide everything in one place so that you can get your job done efficiently. Being a trusted leader since 1995, H&R Block has been the go-to option for Mac users for quite a while now.

Further, H&R Block has continued to evolve in the ever-changing tax software industry, and its latest version for Mac users is the most complete, up-to-date, and accurate version yet. Whether you are an experienced veteran or just starting out, H&R Block is one of the best tax software options available for Mac users in 2025.

Pros

- Professional tax advice in one place

- File sharing on the go with secure document storage

- H&R Block Emerald Prepaid Mastercard® 110 is easy to use

Cons

- Comparatively expensive

- Importing documents is occasionally glitchy

Price: Plans start at $55

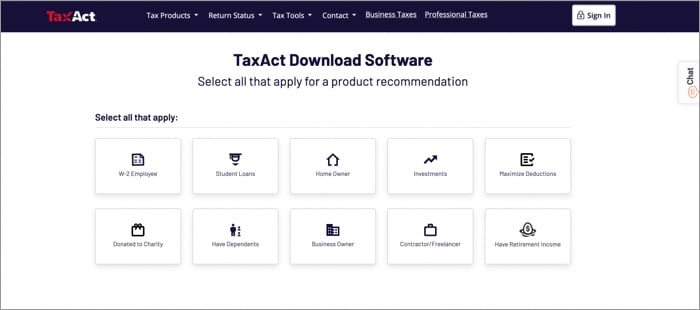

3. TaxAct – Dependable and intuitive

Being the best can sometimes lead to heavy prices. You may find TaxAct to be comparatively more costly than the rest, but we cannot deny that the services provided are top-class. Apart from being the best choice for Schedule C business owners, this software is user-friendly and offers support for multiple tax forms.

The tax planning tools and audit support make TaxAct a great option for those who seek to save money without compromising the quality of the service. Additionally, the built-in support for the latest tax laws and regulations ensures that your taxes are filed correctly. Further, if you are a business owner, I’d recommend perusing our list of task management apps to stay on top of your work.

To accommodate every user respectfully, from first-time filers to experienced tax professionals, there are a ton of options available, from basic to advanced. TaxAct walks you through the filing process, from entering income to selecting the correct deductions. As a result, you can navigate through all complicated IRS regulations and forms to receive the best tax savings.

The software offers an extensive library of tax forms and guidance, detailed instructions to help with filing, and a built-in audit shield to help protect users from any potential audits. TaxAct is a great choice for Mac users needing the best tax software.

Pros

- Most suitable for mid and small-sized business

- 24/7 customer support

Cons

- Compatible with only web platform

Price: Plans start at $44.95

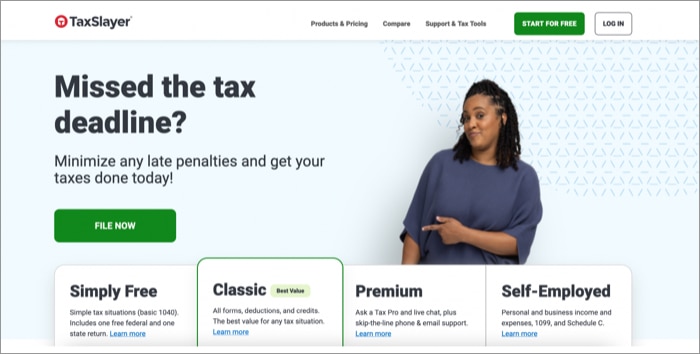

4. TaxSlayer – Affordable plans

TaxSlayer is a cloud-based tax software designed for users to easily file their taxes safely and quickly. The support of a wide range of forms alongside a full range of features – from automated tax filing to accuracy checks to direct payment options – make this tool one of a kind. As a bonus, TaxSlayer is affordable and simple to use.

With the simplified process of data entry, users can fill out the forms without any hassle. You can be assured of accuracy since TaxSlayer is integrated with powerful algorithms and double-checking techniques. Additionally, users can take advantage of a variety of features, such as automatic tax deductions, tax preparation reminders, and more.

Further, the software only gets better. It comes with free tax guidance support, no fee for filing state taxes, and no-cost refund policies. Moreover, TaxSlayer is compliant with all federal and tax laws. Even if you find yourself stuck with problems like IRS e-file, do not hesitate to take it up with TaxSlayer.

TaxSlayer has a great customer support system, offering live chat and phone support to answer queries of any kind. All in all, with its range of features and customer support options, TaxSlayer is the perfect choice for anyone in need of a Mac-friendly tax software program.

Pros

- The basic 1040 tax return can be filed for free

- Perfect choice for new tax filers

- Fastest tax refund

Cons

- Chat support can often take a long to respond

Price: Plans start at $39.95

5. Credit Karma – Free for all

Credit Karma is the tool you need if you’re on a tight budget and are closing in on your financial year. Supporting a series of tax forms, the software is user-friendly and the ultimate solution to all your accounting needs. Credit optimization tools, as well as audit support, are just icing on the cake. The speed and accuracy of this software make it worthy of a prominent tax solution.

The software supports a ton of filing types, including joint filing, free filing of federal taxes, and free live tax advice. You can, furthermore, enhance your profit margins from the range of discounts and credits saved on your taxes. Through powerful reporting and filing capabilities, it allows its users to stay assured in case of any adversity.

Risk management tools, income verification, and asset tracking are some of the advanced features of Credit Karma that can help you in the long run. However, if one or the other way, you find yourself stuck in the middle of the process, certified tax professionals will be there for personalized advice.

Further, you can import your data from the previous financial year. So, basically, this software covers everything in one place. Therefore, take a trail with free IRS filing, no-cost returns, and free direct filing to have an on-hand experience of the best in the industry. Credit Karma is an excellent choice for Mac users looking for effective and affordable tax software.

Pros

- Build credit while paying taxes

- Application available

- Comprehensive resources

Cons

- Occasionally glitchy

- A constant barrage of credit card and loan options

Price: Free

6. TaxJar – Cost-effective solution

If you’re looking for software specializing in sales tax and e-commerce businesses, then TaxJar is the right option. Supported by a bunch of e-commerce platforms, TaxJar offers unique features like automated sales tax calculation, tax reports, and filing assistance. With TaxJar, you can quickly set up and file your taxes, get smarter deductions, and maximize your refund.

Furthermore, the powerful tracking and analytics ensure that you stay on top of your taxes and don’t fall behind. Every year, the software is updated to comply with the latest laws and regulations, making it a reliable source you can trust. TaxJar also offers an automated system that allows users to track expenses, analyze their data, generate reports, and file their taxes.

This software can even sync with popular applications like QuickBooks, allowing you to manage your taxes more efficiently. Nonetheless, if you’re still unsure about TaxJar, don’t hesitate to sign up for a free trial for 30 days without signing up with a credit card. Make the most of the 24/7 customer support for both individual and business taxes.

Whether you’re an individual, a business owner, or a freelancer, TaxJar is the perfect solution for Mac users in need of efficient, reliable, and cost-effective tax software. From simple to complex, TaxJar makes tax filing easy on Mac. Streamline the process of filing your taxes with the cheapest option at your disposal.

Pros

- Free trial available

- Free plan available

- Low-cost subscription

- Audit management

Cons

- A few submission processes are not well explained

Price: Plans start at $19

FAQs

Many tax software options offer tax planning tools that can help you prepare for future tax years. These tools can help you identify tax deductions and credits that you may be eligible for and provide guidance on how to optimize your tax strategy.

While tax software can greatly reduce the risk of errors, it’s important to note that no tax software can guarantee that your taxes are filed accurately. It’s still important to review your tax return carefully before filing and seek assistance from a tax professional if you have any questions or concerns.

Yes, Credit Karma offers a free tax software option for Mac users. However, it’s important to note that the free version may not offer all of the features and support that paid software options provide.

Yes, there is a wide range of applications for managing taxes on iPhones and iPad that can help you significantly.

Don’t take chances; file your taxes!

As a Mac user, finding reliable tax software that can help you file your taxes accurately and efficiently is crucial. With user-friendly interfaces, a range of features, and varying price points, these tax software options have been selected as the best for Mac users.

So don’t stress about your taxes any longer. Choose the software that’s right for you, and let it do the hard work.

Read more: