The modern world requires us to have multiple sources of income. Investing in stocks is a great way to accomplish this. What if you don’t know anything about investing in the stock market? Is it even possible to pick the best iPhone stock trading app among the gazillion available on the App Store?

This guide will help you choose the best one. But before that, let us help clear the basics to boost your confidence in online financial investing.

Note: I have compiled this list of the best trading apps after testing each for more than 30 parameters. These apps are accessible through your iPhones, iPad as well as laptops. Most of these apps can be operated using Apple Watch as well, so you never miss an update from your leading share.

Are investment apps safe?

Yes. Investment apps are 100% secure; you do not have to worry about that. Consider these apps to be a shop that lets you make the purchase. Let us understand this with an example.

For instance, if you wish to buy a piece of furniture for your abode, you will go to IKEA. Substitute IKEA with your best stock broker app, and that’s it!

Well, that does make it sound a little easy. But you may wonder, how to choose the one for you? If you are a beginner, you will need an app that spoon-feeds you the information and helps you learn and invest simultaneously.

How to choose an online stock trading app?

While picking up the right app, you need to understand the services provided rather than the stocks because companies remain the same regardless of the platform.

Moreover, the best stock trading apps for beginners will have $0 or a low brokerage and ETF trades and cater to a fully-featured online trading experience.

There are several other factors, such as the platform’s safety, brokerage, miscellaneous charges, etc. But don’t get overwhelmed!

I have covered a few essential points below that I wish someone had told me when I started trading:

- Quick and timely execution: Your trading platform should facilitate the trades quickly and with utmost precision. The prices fluctuate every second, and you do not want to miss a good deal. Every cent counts!

- Safe to use: The app will carry your private information and a lot of money. Thus, it has to offer top-notch security.

- Simple UI: For a stock app, it is essential to keep the interface simple. Buying or selling a stock should be possible with two or three taps on your screen. A complicated process takes up a lot of time, and you may miss the entry point.

- Diversity: You need an app that is as diverse as Rachel’s trifle. It can let you trade in stocks, currencies, commodities, as well as for cryptocurrencies. Well, there are separate apps available for everything; you need a one-stop destination.

- Fees: You don’t want an app that ends up eating all your profits. The app must have limited fees and no hidden charges.

Now that the basics are clear, let me help you pick the right app.

5+ Best stock trading apps for iPhone and iPad

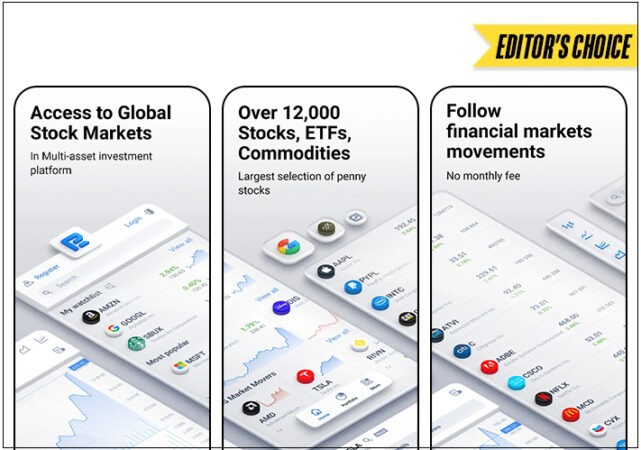

1. R StocksTrader: Editor’s Choice

What’s better than trading? Smart trading with the R StocksTrader app. The platform provides safe access to global financial markets, opening better earning opportunities. The app gives real-time price updates of instruments to help you diversify your portfolio with profit-making investments.

In addition, you don’t have to worry about hopping to different platforms because R StocksTrader gives instant access to 12,000+ instruments to trade, including ETFs.

As part of its tools, the app has detailed information for each stock, market data, stock charts, corporate actions calendar, financial indicators, and so much more. Moreover, you can invest in fractional stocks and set limit orders for a more controlled investment.

Is it worth your penny?

Ideal for beginners- Try the demo account if you are a beginner. Here, you can invest in a real financial instrument without risk. Your capital will be safe while you learn the trading dynamics.

Updated stats- RoboMarkets StocksTrader app gives real-time updates on stock price fluctuations and market conditions. The individual newsfeeds, watchlists, and charts make understanding complex data easy.

Multi-asset collection- The app has more than 12,000 financial instruments to invest in. Here, you can access stocks, EFTs, commodities, and precious metals like gold and silver.

Economical- R StocksTrader claims to have the lowest stock commission fees. You also don’t have to pay any monthly fees.

Pros

- Multiple instruments

- Free demo account

- Low commission fees

- Timely notifications for market changes

Cons

- No cons found

Price: Free

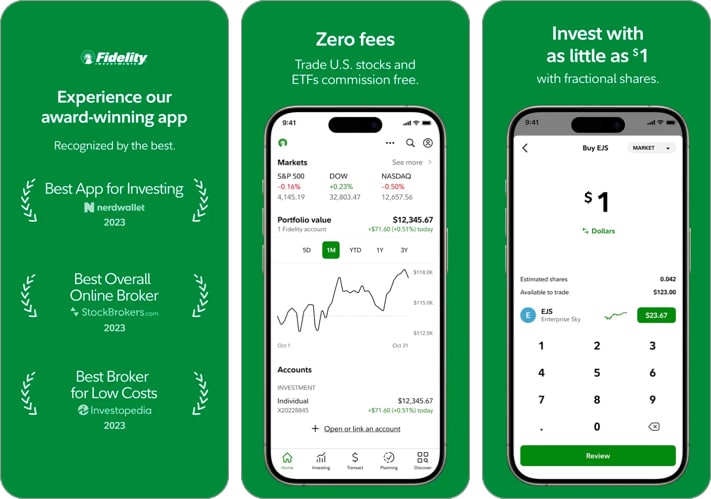

2. Fidelity Investments: Best for mutual funds

A value-driven app offering $0 trades, excellent research tools, and a user-friendly mobile app, Fidelity is indeed funding my retirement plans.

Thus, Fidelity is the best stock app for investors. Unlike other trading apps, it does not charge additional fees for penny stocks. The app also offers many zero-expense ratio mutual funds, which refer to self-indexed funds for individual investors.

These funds include Fidelity ZERO Total Market Index Fund (FZROX) and Fidelity ZERO International Index Fund (FZILX).

Is it worth your penny?

- Best for research: The app delivers value to its clients. Whether you are viewing stocks, mutual funds, or ETFs, you can have them analyzed in excruciating detail before making a purchase.

- Smooth for day trading: Fidelity Active Trader Pro desktop is the best platform for day trading. Hands down!

- Winner for beginners: The app comes with many resources (videos and podcasts) for beginners to understand trading.

- Enhanced voiceover: Fidelity comes with an enhanced voiceover experience and dynamic type.

Pros

- Screening for trade ideas

- Customizable dashboard

- 22 different drawing tools

- Permission to invest in fraction shares

- International trading in 25 countries

Cons

- The active trading department must be improved.

My two cents: Fidelity is not meant for active trading. Download it for investments.

Price: Free

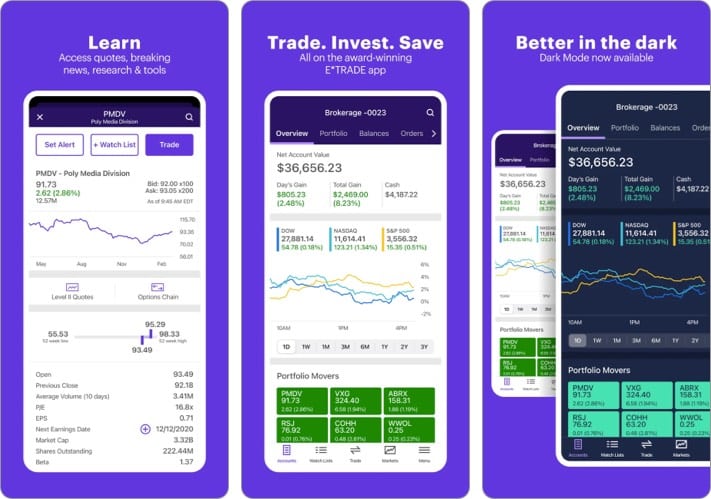

3. E*TRADE: Best for day trading

One of the first online brokerage firms in the US, ETRADE, started operating in 1982 and has been a user favorite ever since. The app’s Power ETRADE platform is the best for options trading and active trading.

The app lets you trade during pre and post-hours at an ECN fee of $0.005/share. ECN fees are the cumulative amount that you are charged for buy and sell orders.

While you can have regular stock and ETF trades at $0, option trades run at $0 + $0.65/share.

ETRADE charges $6.95 for penny stocks. Initially built as a web-based platform, it has grown into one of the best stock broker apps.

Is it worth your penny?

- Sleek design: The app comes with an appealing design and offers diversity in trading tools.

- Chart IQ: Powered by Chart IQ, the app comes with extremely smooth panning and zooming 114 optional technical indicators, and technical analysis.

- Tools for beginners: E*TRADE comes with many research and analysis tools such as StrategySEEK, LiveAction, Snapshot Analysis tool, etc.

Pros

- Educational libraries for everyone

- Banking services across the US

- Chart IQ-powered charts with more than 10 user-friendly indicators

Cons

- Does not support international trading

My two cents: It stands out as one of the best resources for day trading. Give it a shot if you are a beginner.

Price: Free

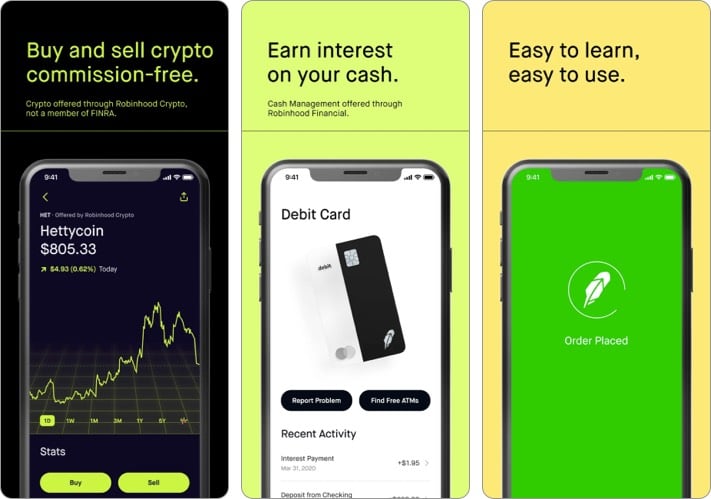

4. Robinhood: Best for beginners

A one-stop destination, Robinhood lets you invest or trade in cryptocurrencies, stocks, ETFs, or options. The tool is optimized for beginners and designed to highlight the core basics for you.

It is safe to say its simplicity is its greatest strength. It gives an insight into real-time purchases, which helps you solidify your research. With parameters such as ‘people also bought,’ you can frequently see the hot stocks updated to make your purchase.

Don’t forget to taste Robinhood Snacks, a delicacy serving newsletter and podcast. I have been a subscriber for a long time now. It is the best in the market.

Most of the online stock trading apps do not offer trading cryptocurrencies. This makes Robinhood an exceptional app on the list. Apart from this, it also offers a cash management service for its users. You can have your debit card under this scheme.

Is it worth your penny?

- Automated investments: With tools like recurring investment tools and dividend reinvestment tools, the app will automate your investment cycle.

- Clean design: Robinhood is the perfect example of simplicity at its best. With a design that simple, you can see yourself becoming the master in a couple of weeks.

- Robinhood Gold: Avail this service for day trading. The package is quite steep and sells at $5/month.

Pros

- One-stop solution for crypto and stock, funds, and options

- Multiple tools to guide you with purchases

- Commission-free

- Award-winning design

Cons

- Poor research tools

Price: Free

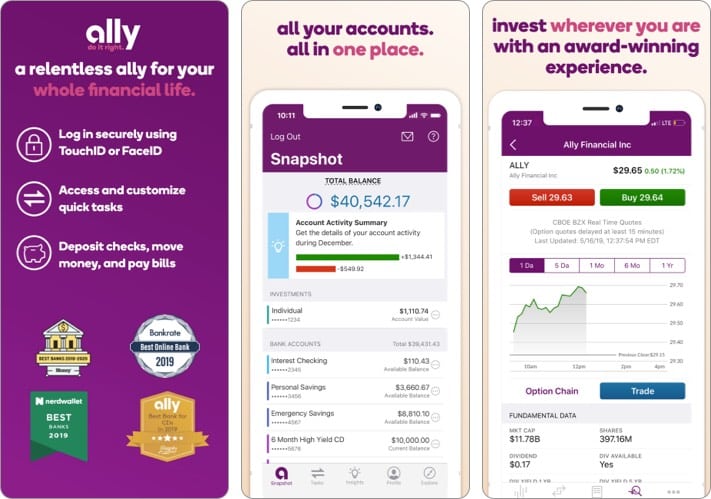

5. Ally: Best for banking benefits

A one-stop destination for high-quality checking, savings, and investment accounts. It is a perfect combo of an investment bank and an online brokerage.

With a zero-commission app, you need not pay charges for stock or ETF trades. However, you need to pay 50 cents flat per options contract for an options trade and $9.95 for no-load mutual funds.

The app lets you automate your investment with one of their portfolio strategies. And monitor the goal progress using Goal Tracker.

I admire the platform because it lets me set up recurring transfers to my investment account. I research with the app’s tools, set my portfolio up with real-time support, and work on my profits with my skills. What more can I possibly ask for!

Is it worth your penny?

- One-stop destination: It provides both banking and investment opportunities on the same app, increasing the convenience factor.

- Commission-free trade: Eligible US stocks and ETFs are commission-free. Invest as much as you can!

Pros

- Universal access from any device

- No minimum deposit

Cons

- Works great only if you are a valuable customer to the bank.

Price: Free

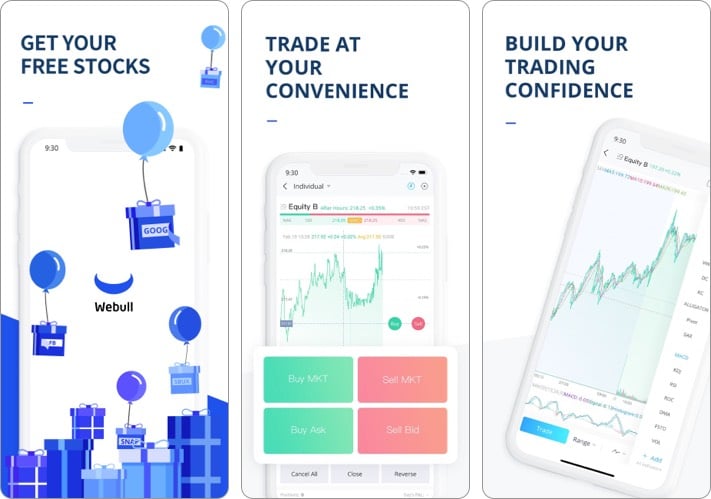

6. Webull: Best stock app for minors

An insightful community experience to target young traders and investors. Well, it may not offer mutual funds, bonds, or futures; it is offering $0 ETFs/stocks as well as $0 crypto trades.

Webull also stands out as one of the few trading apps in the market, with no minimum deposit. Yes, you don’t need to have $1000 to trade unless you are shorting stocks.

Shorting stocks refers to selling stocks to the market at a higher price and then buying them when the market goes down.

The charts on the app are super clean and easy to use. With that being said, they come in with more than 50 indicators and multiple layouts to compare these charts. Webull also offers screeners, analyst ratings, price targets, and lists of ETFs.

Is it worth your penny?

- Community-driven: Unique social community features to engage the young audience spreading awareness about investing at an early age.

- $0 option trades: While most companies charge $0.65-$0.75 for options, Webull charges you nil.

- Universal interface: The mobile app UI resembles the website, making it more straightforward to understand the momentum and easy to use.

Pros

- Allows shorting

- Dozen crypto in your wallet

- Consistency across multiple devices and OS with a similar UI

- Get advanced real-time options for data

Cons

- More research materials should be provided

Price: Free (In-app purchase starts from $1.99)

In today’s tech-advanced world, trading stocks seems like a game of chess.

You may also like to read: