Tech giant Apple has managed to create a buzz in the financial market with the introduction of its very own Apple Card, a 0% fee credit card backed by Goldman Sachs. Though the card is yet to be rolled out fully, it has already been seen as a major competitor in the market, in part due to the popularity and loyal fan following of Apple products.

Announced during Apple’s special event on March 25, 2019, details about the Apple Card were finally made public just a few days ago. Everything from its unique Titanium body to the easily accessible UPI has been enticing audiences, and none of us could wait to get our hands on the coveted Apple card.

A Side by Side Comparison of Apple Card vs. Other Credit Cards

When it comes to credit cards, the best choice depends on your usage as well as the features offered by the said credit card. We compared the offers and facilities by Apple Card with three other cards that are currently the favorite in the market, viz. Citi Double Cash, Chase Freedom Unlimited, and Uber Visa Credit Card.

All four credit cards are evaluated over various pointers such as Annual fees, sign-up bonuses, rewards/cashback, reward accrual, reward redemption, APR, foreign transaction fee, and penalty.

But before we go further, let’s know a bit more about the Apple Card:

About Apple Card

Packed with unique features, Apple Card flaunts elegant and minimalist design with great ease of access. Apple Card is basically designed to live inside your iPhone in your Wallet App.

Made of titanium, you can use the physical credit card by swiping, similar to other credit cards or you can use online or wherever Apple Pay is accepted via your iPhone. Yet again stepping outside the box, Apple does not feature the usual card number on its Apple Card, ensuring another layer of privacy and security.

Famous tech Youtuber, Marques Brownlee recently received his Apple Card and shared his first impression about the card on his channel. Brownlee was particularly impressed by the sleekness of the card both in terms of its design and its material. Here’s the full video:

Apple Card in Comparison to Other 0% Fee Credit Cards

Apple has single-handedly managed to change the world’s outlook towards smartphones and what can or can not be done with a phone. This time around when the tech giant forays into an already well-established and somewhat saturated market, would it be able to continue its streak of being a pioneer?

We compared the offers and facilities by Apple Card with three cards that are currently the top favorites in the market: Citi Double Cash, Chase Freedom Unlimited, and Uber Visa Credit Card.

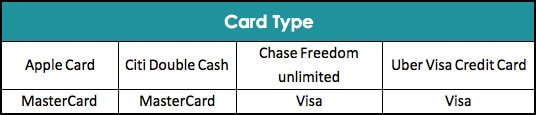

Card Type

Annual Fee: All four cards have no annual fee.

Sign-up Bonuses

- Apple: No sign-up bonus

- Citi Double Cash: No sign-up bonus

- Chase Freedom Unlimited: $150 cash back after spending $500 within the first three months

- Uber Visa Credit Card: $100 cash back for spending $500 in the first 90 days

Rewards

- Apple: 3% cashback on all Apple purchases, 2% on all purchases via Apple Pay, and 1% on all other purchases

- Citi Double Cash: 2% (1% upon purchase and 1% upon bill payment)

- Chase Freedom Unlimited: 3% on all purchases for the first year, up to $20,000. After a year it doles out unlimited 1.5% cashback on all transactions

- Uber Visa Credit Card: 4% points are added on dining including UberEats, 3% during airlines, hotels and travel booking, 2% online bookings, 1% on all other purchases

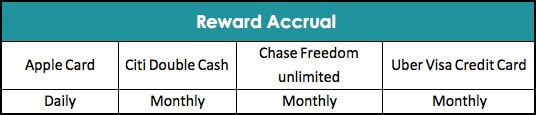

Reward Accrual

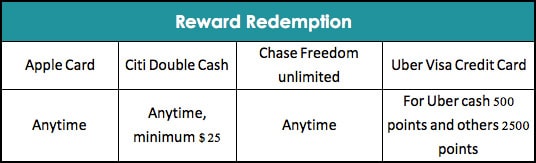

Reward Redemption

APR

- Apple: variable APR of 13.24% to 24.24%, depending upon credit limit

- Citi Double Cash: 0% on balance transfers for an initial 18 months, and then Variable APR of 15.99% – 25.99%

- Chase Freedom Unlimited: 0% Introductory offer for first 15 months, then switches to a variable APR 17.24-25.99%

- Uber Visa Credit Card: 17.24%, 22.99%, or 25.99% Variable APR for purchases and balance transfers

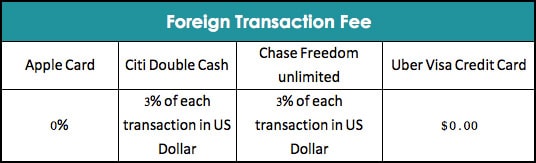

Foreign Transaction Fee

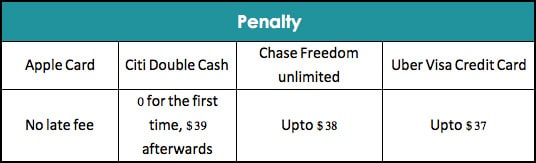

Penalty

Though Apple Card does not charge a late fee, you’ll have to pay interest on your outstanding balance. Also, note that a late payment will indeed impact your credit score as is the case with other credit cards.

Additional Benefits of Apple Card

Security

So as to make your usage more secure and safe, Apple Card does not have a card number or other details like CVV on the card. You can find your card number through your wallet app.

In case of a stolen or misplaced card, you do not have to call Apple support; all you have to do is block your card through your phone. Your Apple card can only be operated by your iPhone and requires your Face ID or Touch ID to be activated.

Interest Rate Clarity

Another positive feature of Apple Card is its transparency; you can check the interest rate charged at any moment through Apple Wallet. With a simple dial like feature, you can also see the increase or decrease in the interest rate upon your Apple Card payment.

Tracking your Spends

You can not only check your spending through the Apple Wallet; you can even check where you have spent. In fact, if you can’t remember, it can jog your memory with a map pointer as well.

In addition to monitoring your spending, the Apple Wallet also categorizes your expenditures. So, you will know how much was spent on food, online shopping, bills, etc. Interestingly, your physical card is white, but the virtual card in Apple Wallet picks up colors as per the money spent on each category, showing your spending habits in a glance.

No Need for a Physical Card

While the sleek card is stylish enough to carry everywhere, it is not necessary for you to do so; you can just use your iPhone to handle the payment.

Issues with Apple Card

Compatibility with the Apple Ecosystem: You will only be able to use an Apple Card if you are part of the Apple Ecosystem. Based on Apple Pay, it requires a wallet app for registration, activation, and payment. Once activated the physical card can be used everywhere, but to avail full benefits of the card you will require an iPhone, iPad, MacBook or an Apple Watch.

Availability of Apple Pay: While 2% cash back on every purchase is quite lucrative, it is only possible if paid through Apple pay. Although its reach is increasing, not all merchants accept Apple Pay as of yet. So, you might have to wait some more time to reap the full profit of 2%, until then 1% will be your best bet.

Signing off…

Apple Card has its pros and cons, and other competitors do have some comparable features. However, none of the cards in the market offers a package as centralized and tidily bundled as Apple does.

While the choice of credit card is often very personal, depending upon your expenditures, having a card tightly linked with your phone will always be a great plus. On top of it all, Apple Card’s winning USP is its simplicity, ease of use, and transparency in terms of payments and interest rates.

You may also like: