If you’ve ever filed tax returns, you know how frustrating and time-consuming the paperwork can be. Enter iOS tax apps that digitize and streamline the process to make your life easier. But can you trust these apps with such a vital aspect of your finances? And do they effectively get the job done? Well, I did some digging to find this out for you, along with a hand-picked list of the best tax apps for iPhone and iPad to help file your returns efficiently.

What is a tax app, and how does it work?

Tax apps simplify the grueling process of filing your returns. Most of them are built by reputed financial or legal software companies and have accompanying web portals. They are the go-to place to understand the income tax filing process better and get your returns done in an organized and manageable way.

A tax app, much like a professional tax preparer, walks you through selecting the tax forms you need, collecting your tax information, and finally submitting your return to the IRS.

It automates much of the tax filing process so that you no longer need to manually fill out forms, calculate deductions, identify which taxes you owe, and learn about the latest tax rules.

Who can benefit from the tax app?

Well, it is suitable for all kinds of users, from salaried individuals to independent contractors and self-employed people. Plus, it includes adequate safety and security protocols to guard your information.

While most apps let you file simple returns for free, you can pay for expert guidance for more complicated situations such as additional income sources, self-employment, etc.

Now that you know the basics, check my top options.

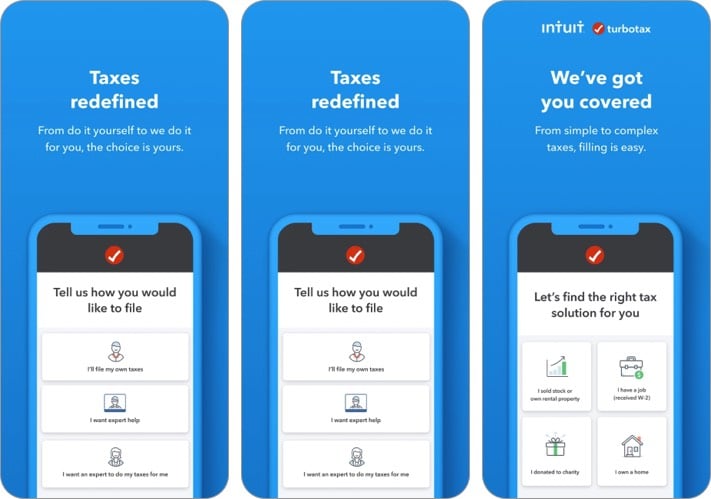

1. TurboTax: File Tax Return

I found the TurboTax app to be the most well-designed and easiest to use among the bunch.

To file your taxes, you have to scan your W-2 and other documents using the camera on your iPhone or iPad. The app will then add this information to the relevant forms. You can trust the process and be worry-free because it is a product of the well-known financial software company ‘Intuit.’

You can also use it to scan the barcode of your driver’s license to upload info like your name, birth date, and address.

I especially appreciate how the TurboTax app allows easy integration across devices, so you can, for instance, start the process from your phone and then switch to your iPad or computer, picking up where you left it.

It also offers excellent support from tax experts, including via video chat. Although you’ll pay a premium for this, you’ll get an excellent level of support that’s equivalent to consulting a tax specialist in person.

Lastly, after filing, you can opt to see push notifications about your return status to stay in the loop.

What I loved

- Easy to understand, navigate, and use

- Seamless sync between devices

- Best for those filing simple returns

What could be better

- Not suitable for those with investments or trading incomes

- It’s only for personal tax returns. You cannot file for businesses not reported on Schedule C

Price: Free

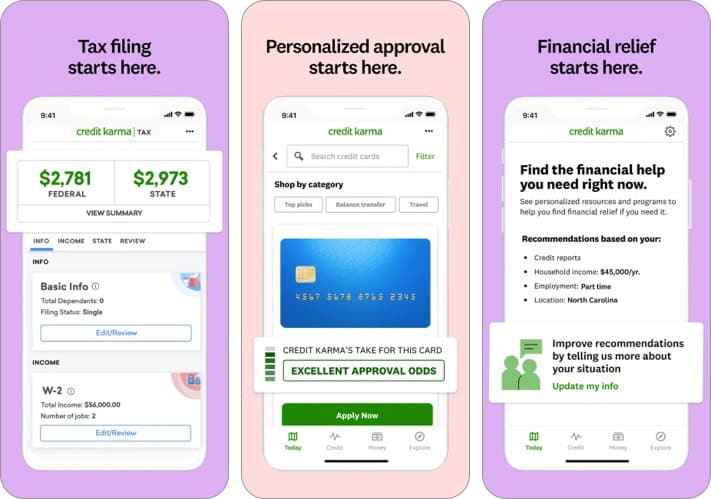

2. Credit Karma

I firmly believe this is one of the top finance apps that everyone needs on their phones. It’s the go-to place to check and take control of your credit scores. But it’s also a completely free tax filing app.

This includes simple tax returns and more complex tax returns for self-employed individuals and those with business or investment incomes. You can also import previously filed taxes from other services, such as TurboTax.

There are impressive security feature,s such as data encryption, two-factor authentication, etc., to protect your information. You can also get help via the Credit Karma Tax help center, plus you can send a message to the team for support, although you can’t receive live support from a tax expert.

Moreover, everyone who files their taxes using the Credit Karma tax app gets free access to audit defense. You usually have to upgrade to one of the top plans to get this type of support.

The best part is that if you have a simple return and are comfortable using DIY software, you can file your documents yourself using this app without professional help.

The app supports various tax situations, such as income from a rental property, student loan interest, and income made as an independent contractor. These are not easy to come by in other tax apps.

What I loved

- It’s free for everyone, including those with complex tax situations such as self-employment or investment income

- Free audit support is provided to everyone

What could be better

- Some state tax returns aren’t supported

- No one-on-one support from experts

Price: Free

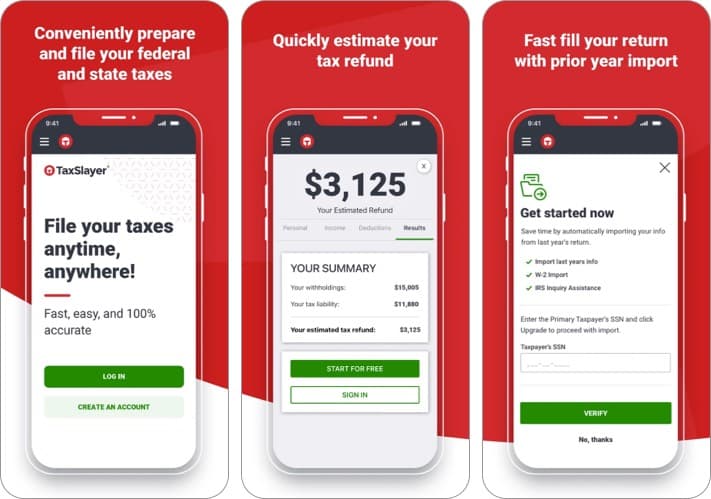

3. TaxSlayer Free Tax App

TaxSlayer eases the stress of tax filing with step-by-step instructions and a 100% accuracy guarantee. You can also get unlimited phone and email support from those who understand the legalities!

I found it helpful because it provides detailed information for all Form 1040-related issues. You can also search for your specific topic in an extensive database of help files. Further, the user interface is easy to navigate and helps you get your e-filing process done effectively.

At the same time, it’s quite an affordable service with comprehensive support. These are the four plans it offers:

Free: for federal and state returns for Form 1040 filers. It includes W-2 and education deductions and credits.

Classic: $17 for federal returns with support for all major IRS forms and schedules. You can import W-2 data from payroll providers and draw information from your previous year’s file.

Premium: $37, includes enhanced support options, audit assistance, live chat, and unlimited phone contact with tax professionals.

Self–Employed: $47, includes additional guidance for self-employed tax filers.

What I loved

- Affordable

- User-friendly

- Extensive knowledge base of taxation

What could be better

- It lacks in-depth, personalized help from professionals

Price: Free

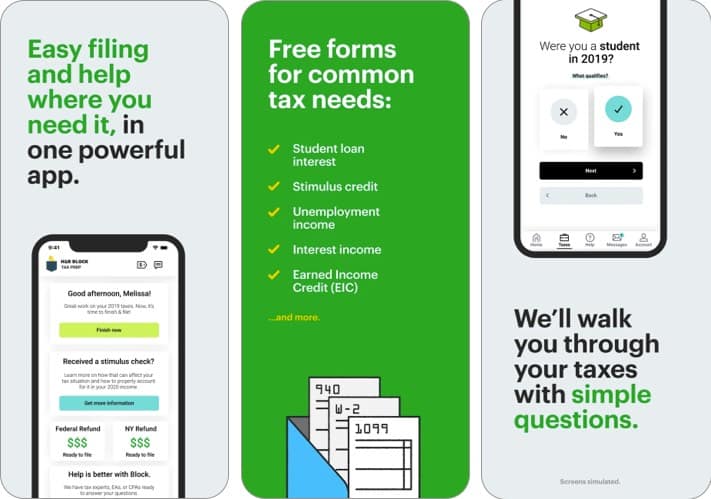

4. H&R Block Tax Prep and File

Here’s another excellent iOS tax app that makes it free to file simple state and federal tax returns. But if you have a more complicated situation, the app charges between $49.99 and $194.99.

It’s easy to import your previous year’s returns regardless of which service you used to file them. Use your device camera to scan and upload your W-2.

Of course, you can trust this app because it includes industry-standard data encryption and security factors that protect your data. I also tried switching between the mobile app and the website and was pleased to find that it syncs well.

Further, if you run into any issues, you can get free live tech support via chat or phone.

It includes credits and deductions that other tax filing apps might make you pay for, such as student loan interest, tuition, Social Security income, and unemployment income. You also get a free mid-year tax check-in and free audit assistance.

Lastly, if you need professional guidance or advice, you can go for one of the paid plans, which are especially great for self-employed filers.

My favorite option is that you can pay for a tax professional to do your taxes for you. It costs about $69.99 per federal return, but it’s worth it if you’re short on time or just want to make life easier.

What I loved

- Great user interface

- Easy-to-understand instructions

What could be better

- A bit more pricey than other options

- You have to pay an additional fee for individual support from a tax expert

Price: Free

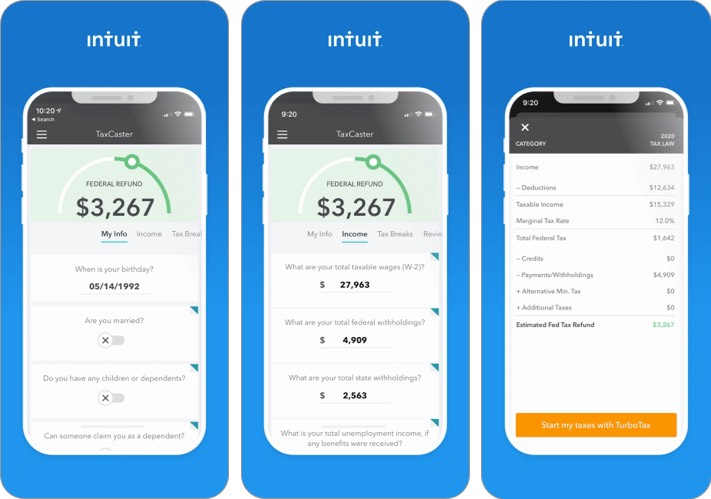

5. TaxCaster: Tax Calculator

The final option on my list of the best income tax apps is this free interactive tax calculator that provides quick and accurate insights into how much you will get back or owe.

Unlike the other apps on the list, TaxCaster does not prepare your taxes. It just gives an estimate of them. It’s also from Intuit and is an accompanying app for TurboTax, which you can use to file returns. There’s a nifty navigation drawer that lets you easily switch to TurboTax and other Intuit apps, such as Mint.

I found it incredibly easy to use, and you can start by just entering some basic information. Then, get an estimate from the federal income tax calculator to get insight into your taxes before preparing your return.

You can even run scenarios on events like getting married, having a baby, or buying a home. Further, adjust your paycheck withholdings to take home more money or plan ahead to pay less tax.

Lastly, this app also supports Spanish, so it’s excellent for bilingual filers.

What I loved

- Great for planning ahead

- An excellent companion for TurboTax

- Spanish language support

What could be better:

- Does not cover all possible tax situations

- The accuracy of predictions is subjective

Price: Free

FAQs

After analyzing at least 10 applications, I found TurboTax: File Tax Return and TaxSlayer Free Tax App to be the best tax apps for iPhone and iPad.

Well, this depends on your unique situation. The refund amount does not depend on the app but rather on your finances.

Yes, provided you use such reputed apps as TurboTax, which include security standards and are developed by well-established companies that you can trust.

You may want to take a peek at: